The Company has in place a corporate risk management system (CRMS) based on generally accepted conceptual models of risk management and recommendations developed by the Committee of Sponsoring Organizations of the Treadway Commission (COSO ERM Enterprise Risk Management Integrating with Strategy and Performance).

The main principles of the CRMS in the Company are defined in the Policy on risk management and internal control as approved by the resolution of the Board of Directors dated 04 November 2019 (minutes No. 145), which is publicly available on the Company’s official website.

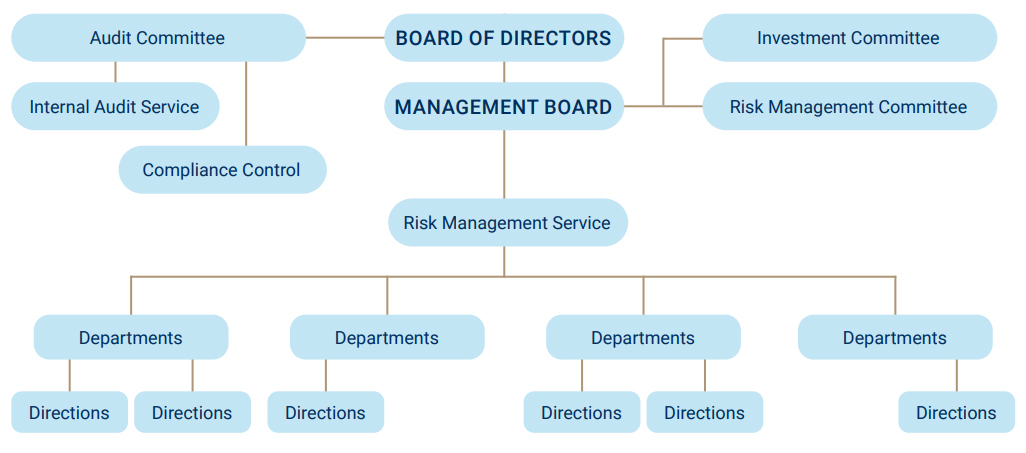

The structure of the risk management system in the Company is represented by risk management at several levels involving the following bodies and subdivisions of the Company: Board of Directors, Management Board, Risk Management Committee, Internal Audit Service, Compliance Controller, structural unit responsible for risk management.

The Company has in place an internal control system, which is a tool that allows the management making decisions aimed at promptly identifying and preventing risks, and providing reasonable confidence in the achievement of the Company’s strategic goals.

The meetings of the Risk Management Committee are organized in the Company on an ongoing basis, reports are heard and actions to manage significant risks are discussed, and reports are submitted on the actions taken to improve the CRMS. The information about realized risks is timely brought to the attention of the Management Board and the Board of Directors of the Company.

Structure of risk management system

ACTIONS TO IMPROVE THE CRMS

The Company’s CRMS is a set of interrelated elements combined into a single process in which the Board of Directors, management and employees participate in identifying potential events that may affect the activities of the Company, as well as in management of these events within an acceptable risk level.

The Company annually develops and performs a set of actions to improve the CRMS effectiveness. In 2021, the actions were taken as part of the CRMS improvement, including:

- The approved Plan for the improvement of corporate governance of the Company for 2021–2022 included the actions for the improvement and functioning of the risk management and internal control system in the Company;

- A part was taken in interviews with independent consultants on the functioning of the risk management and internal control system as part of the diagnosis of corporate governance of the Company;

- Materials were provided on the functioning of the risk management and internal control system as part of the diagnostics of corporate governance of the Company by independent consultants based on the results of which it was planned to update the Plan on the improvement of the risk management and internal control system of the Company in 2022;

- Work is performed to consult the employees of the structural units of the Company on the issues related to risk management; consultations with risk coordinators are provided on the issues related to realized risks in the reporting period;

- To improve the risk culture, introductory trainings on risks are conducted for newly hired employees;

- To assess the knowledge of employees of the principles of the risk management system, the tests and questionnaires are conducted on an ongoing basis;

- The Methodology of the internal control system of the Company has been updated;

- For the purposes of prompt provision of the information on realized risks, weekly reports on the risks of the Company are submitted to the Sole Shareholder (the order and form of information provided);

- The risks of completed projects are analysed and an info session is conducted;

- The documents of the Risk Management Committee for the period 2018–2019 were registered, the documents were transferred to the Company archive.

The work on improving the risk management and internal control system will continue in 2022.

SIGNIFICANT RISKS

In 2021, the Company included 22 risks in the register and map of significant risks of which the critical risk is the risk of default in payment of debt by Shar-Kurylys LLP.

At the end Quarter 1 of 2021, the significance of risk P-2 – Risk of default in payment of debt by Shar-Kurylys LLP – was reduced in the risk register due to the conclusion of a mediation agreement and partial fulfilment of obligations to the Company under approved conditions.

Thus, during Quarters 2-4 of 2021, the Company has no risks that are within the critical zone.

In 2021, the Company performed actions to minimize risk realization and consequences from their realization, including:

- ongoing monitoring of the sale of facilities, visits to the facilities, conclusion with developers of additional agreements to the contracts with updated parameters for the sale period and return of investment;

- implementation of a lease payment accounting system to reduce the risks of manual monitoring of payments under rent-to-own agreements;

- control and monitoring of the elimination of identified defects in real estate objects owned by the Company;

- consideration of proposals from counterparties on the fulfilment of obligations under mediation agreements;

- work on the return of troubled receivables;

- prevention of the spread of COVID-19 among the employees of the Company, ensuring the maximum vaccination coverage of employees, receipt of vaccination passports. Medically exempted employees undergo PCR testing on a weekly basis; and

- performing anti-epidemiological actions in the administrative buildings.

The actions of the plan to minimize the other risks are performed on an ongoing basis.